n 2016, the public took to the ballot boxes and rendered a decision that shocked the entire world; voting for the UK to leave the European Union. A year on from the EU Referendum, and the divorce talks between the UK and EU have finally started, with a deadline set for Friday 29th March, 2019 for the UK to leave the bloc.

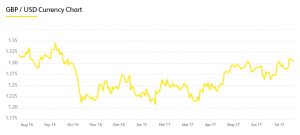

Whether the Government will adopt a ‘hard’ or ‘soft’ Brexit remains unclear (as do solid definitions for the terms ‘hard’ and ‘soft’ in this context), and this uncertainty in whether or not Britain will remain part of the single market has had a strong impact on the broader economy over the last 12 months. On the night of the UK’s decision to leave the EU, the pound suffered the biggest one-day fall against the dollar on record, hitting a 31-year low of $1.2117.

The pound climbed back over the $1.3 mark after Theresa May called her politically and financially expensive snap election, but fell again once the results were in. By the end of June 2017, the pound remained at $1.2666.

Brexit and steel industry: expensive uncertainty

The continued uncertainty around the deal we may or may not be able to achieve for Brexit continues to affect investment and inflation too, with the latter hitting 2.9% in May, its highest since June 2013. This means domestic inflation is now rising faster than pay, imposing further pressure on the cost of living. Investment in the UK has dropped too, falling by 0.9% in the final quarter of 2016 – the first calendar year decline since 2009.

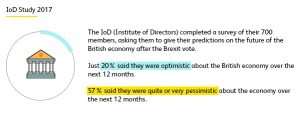

As a result of the Brexit vote, the subsequent economic impacts and the lack of a Government majority after the General Election, researchers are noticing a major slump in confidence among business leaders.

With the effects of Brexit – or rather the uncertainty around the UK’s exit – having a negative impact on the broader economy, it’s no surprise that specific industries are also feeling the pressure. The banking and financial sectors, auto industry and food and drink industry have all noted worrying signs in the last year, but one sector particularly at risk is construction and manufacturing.

The global nature of the sector and heavy reliance on exporting – as well the importance to the industry of the free movement of labour – leaves the sector with a substantial amount to lose during the Brexit negotiations and subsequent exit from the EU. In fact, the Royal Institution of Chartered Surveyors states that approximately 200,000 construction jobs could be lost if Britain was to lose single market access, putting at risk billions of pounds worth of infrastructure projects.

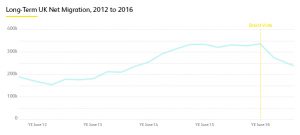

Similarly worrying is the impact on the supply of EU workers to Britain, with the ONS estimating a ‘statistically significant’ drop in net migration between 2015 and 2016:

Steel industry in the UK

One of the most important industries in UK manufacturing is of course the steel industry, which directly employed over 320,000 people as recently as the 1970s. The last few decades however have been tough for UK steel, and Brexit doesn’t look like it’s going to make things any easier. A report from KPMG, released in February of this year, found:

This is particularly worrying for the steel industry, especially after more than 10,000 jobs were put at risk in 2016 when Tata Steel threatened to leave the UK entirely, leaving several plants on the verge of closure. This prompted experts to note that the costs associated with the loss of the steel industry would be greater than the costs of investing to build its future.

Research from the IPPR (Institute of Public Policy Research) demonstrated that the loss of Tata Steel alone would in fact lead to 40,000 job losses, when you take into account the supply chain and businesses who rely on their local steelworks to survive:

As a result many expect the Government to continue to help the steel industry negotiate the tough economic climate in Europe and internationally, but signs have not been good.

Back in February of this year, the British government was accused of ‘disgraceful’ behaviour for their labelling of certain industries as ‘low priority’ as they approached the first round of talks with the EU, including the steel sector.

In a document produced by the Department for Exiting the EU, several industries – including banking, aerospace, automotive and insurance – were marked as high priority when it comes to getting government assistance to deal with the impact of Brexit. Industries such as steel however were marked as being low priority, meaning they could potentially receive little to no assistance from Whitehall.

UK Steel said of the report:

Some experts do believe that Brexit could be a catalyst for growth in the steel industry, with the potential for a string of new policies aimed at turning around the fortunes of the struggling industry. However, the potential lack of state intervention is worrying many within the UK steel sector.

One particularly high-profile piece of research to note the importance of state intervention is the Steel 2020 report, which was released in January of this year following a 12-month enquiry conducted with the University of Leeds Business School. The cross-party paper sets out a blueprint for how the UK Government could turn reshape policy to benefit the industry in the wake of the Brexit vote, putting a particularly emphasis on the role of the state in saving this ‘key foundation industry’.

There is no question then that the UK steel industry is in decline, and Brexit – along with the illegal dumping of Chinese steel – are presenting significant challenges when it comes to ensuring a sustainable, long-term future for the sector.

Of course leaving the European Union could bring with it opportunities as well as challenges, particularly in relation to tackling dumping. Similar to the approach taken by former President Barack Obama in the US, leaving the EU allows the Government to impose punitive tariffs on Chinese excess steel, which would have a major impact on a significant problem within the industry. Similarly, as covered in the Steel 2020 report, leaving the bloc presents an opportunity for policy-makers to redress many of the challenges faced by UK steel manufacturers.

However, at the moment, the overall impact of Brexit on the UK steel industry remains unclear, and will likely remain uncertain until the nature of the negotiated trade deals are revealed, which is almost certain to be years away. It is this uncertainty that is currently having a severe impact on the industry, as it affects everything from credit risk to currency fluctuation to investment.

It should be noted that some of the perceived negative impacts of the Brexit vote – notably the fall in the value of Sterling – have been advantageous to UK steel in some respects. It has made exports an average of 15% cheaper, and increased the cost of dumped Chinese steel by the same margin. However, the UK imports more steel products than it exports, so this advantage is unlikely to make a huge difference overall.

Of course the UK’s access to the European Market is of crucial importance when it comes to the future of UK steel. In 2015, exports to the EU constituted 52% of all steel exports, and 45% of all UK exports of goods and services. The remaining EU nations are the biggest customers of UK steel, and losing the current level of access to the single market could have a dramatic effect.

The Government has made it clear that they are seeking a free trade agreement with the European Union, with the Prime Minister pledging to deliver the ‘best possible access to the European Market’, whether or not this is delivered however remains to be seen, and it’s precisely this uncertainty that makes planning for the future so difficult for those in the industry.